05-02-2025

Budgeting & Expense Management

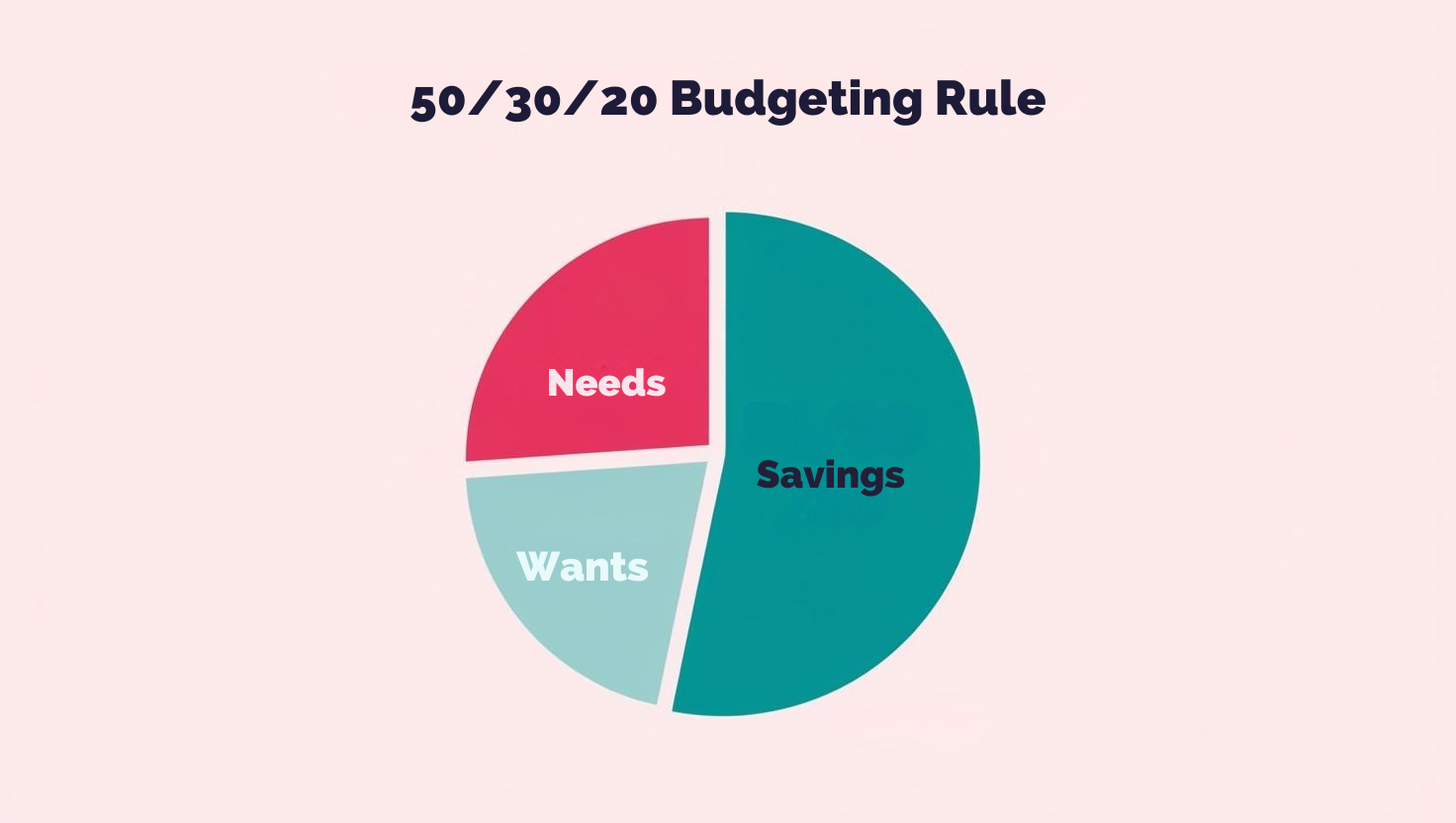

The 50/30/20 Rule: A Simple Approach to Budgeting

Budgeting is one of the most critical skills for managing personal finances effectively. Among the various budgeting methods, the 50/30/20 rule stands out due to its simplicity and practicality. This rule provides a balanced approach to spending and saving that can be adapted to different financial situations.

Understanding the 50/30/20 Rule

The 50/30/20 rule was popularized by U.S. Senator Elizabeth Warren in her book All Your Worth: The Ultimate Lifetime Money Plan. The rule suggests allocating your after-tax income as follows:

- 50% for Needs – Essential expenses, such as rent/mortgage, utilities, groceries, insurance, and minimum debt payments.

- 30% for Wants – Non-essential expenditures, including dining out, entertainment, travel, and hobbies.

- 20% for Savings and Debt Repayment – Contributions to retirement accounts, emergency savings, and extra debt payments.

How to Implement the 50/30/20 Rule

- Determine Your After-Tax Income: This is the amount left after deductions for taxes, health insurance, and retirement contributions.

- Categorize Your Expenses:

- List all your monthly expenses and classify them as Needs, Wants, or Savings/Debt Repayment.

- Adjust Your Spending:

- If you spend more than 50% on Needs, look for ways to cut costs, such as refinancing loans or reducing utility bills.

- If you exceed 30% on Wants, consider scaling back discretionary spending.

- Ensure that at least 20% is allocated to financial growth, including investments and savings.

- Use Budgeting Tools:

- Apps like Mint, YNAB (You Need a Budget), and EveryDollar can help track spending and automate savings.

Pros and Cons of the 50/30/20 Rule

Pros:

- Simple and Easy to Follow – No complex calculations required.

- Flexible – Can be adjusted based on financial goals and cost of living.

- Encourages Saving – Ensures a dedicated portion goes towards future financial security.

Cons:

- Not Ideal for High-Cost Areas – In expensive cities, Needs may exceed 50%.

- May Not Work for All Incomes – Lower-income individuals may struggle to allocate 20% to savings.

Alternative Budgeting Methods

If the 50/30/20 rule doesn’t fit your needs, consider:

- Zero-Based Budgeting: Assign every dollar a purpose to ensure complete control over spending.

- 80/20 Rule: Allocate 80% to expenses and 20% to savings, offering more flexibility.

- Reverse Budgeting: Prioritize savings first and adjust expenses accordingly.

By applying the 50/30/20 rule, individuals can cultivate responsible financial habits, reduce financial stress, and work towards long-term financial security.

Source: Harvard Business Review, "A Simple Way to Plan Your Budget," hbr.org